Important Funds Availability update effective July

1, 2025

Important Funds Availability update effective July

1, 2025

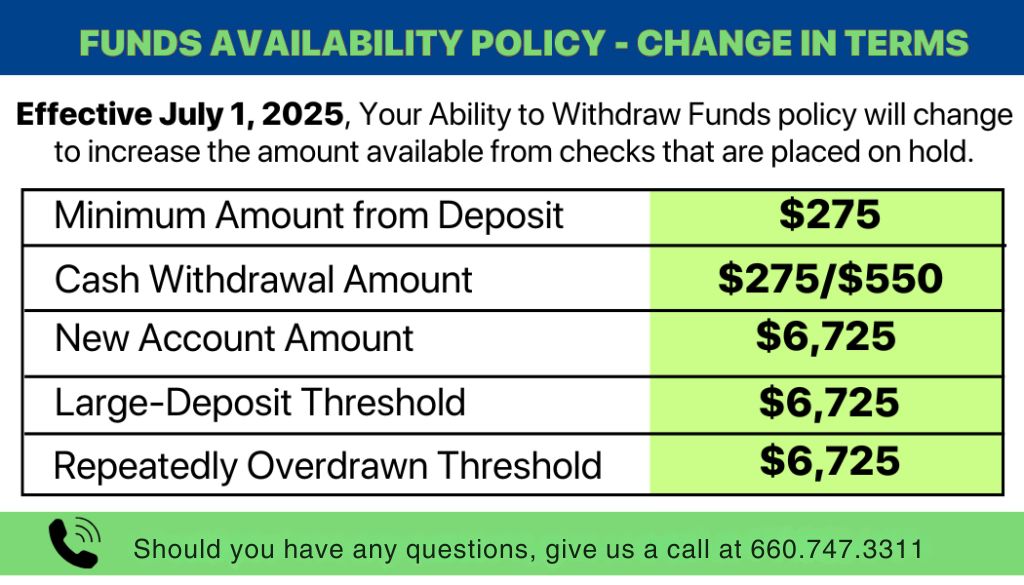

The Consumer Financial Protection Bureau (CFPB) and the Federal Reserve Board jointly adjusted dollar amounts for inflation relating to the availability of accountholder funds. These Regulation CC changes include the minimum amount of deposited funds that financial institutions must make available for withdrawal by opening of business on the next day for certain check deposits, as well as the amount of funds deposited by certain checks in a new account that are subject to next-day availability. What is Reg CC, and Why Does it Matter? Reg CC aims to expedite the check-clearing process and ensure members have timely access to their deposited funds. It sets specific timeframes for when funds must be made available, depending on the type of deposit (cash, checks, electronic transfers) and the location of the paying bank. The chart below lists the inflation-adjusted dollar thresholds for Reg CC funds availability requirements. The changes take effect on July 1, 2025. | |

| |

Here’s what you need to know:

Why did this change? Due to the Expedited Funds Availability Act, which was approved in 2020 to address inflation, the policies and regulations set forth by the Federal Reserve and the CFPB will be adjusted every five years. Please see the 2020 notice below. July 1, 2020 NOTICE The Federal Reserve and CFPB in late June finalized amendments to Regulation CC to implement a statutory adjustment to adjust the dollar amounts under the Expedited Funds Availability (EFA) Act for inflation. The final rule takes effect on July 1, 2020. Dollar amounts will be adjusted every five years beginning July 1, 2020. Following adjustments to the dollar amounts will occur on July 1, 2025, and on July 1 of every fifth year thereafter. The adjustment to Regulation CC also adjusted civil liability amounts for failing to comply with the EFA Act’s requirements. Additionally, the agencies amended Regulation CC to incorporate the Economic Growth, Regulatory Relief and Consumer Protection Act (S. 2155) amendments to the EFA Act, which include extending coverage to American Samoa, the Commonwealth of the Northern Mariana Islands, and Guam and certain other technical amendments. |

| Questions? | Contact Us by telephone at (660) 747-3311, or go to https://www.mycmccu.org |

|---|